- CwC Web3 Weekly

- Posts

- Crypto Market Momentum, ETH Breakout Signals & Base App’s Social Bet

Crypto Market Momentum, ETH Breakout Signals & Base App’s Social Bet

Cap’s friend earns $90 in crypto at dinner

ApeChain Spotlight Sprint breakdown

Why most airdrops fail post-launch

ETH crosses $3,600; supply shock incoming

InfoFi’s incentives under fire

AI agents & Base App’s social push

Watch & Listen Now: This week kicks off with renewed optimism as Cap and Steve explore bullish signals across crypto markets, including rising NFT volume and Bitcoin momentum. Motus Art explains how cinematic pacing and sound can push generative art into immersive storytelling. We examine Blackbird’s Fly token when Cap reveals how a dinner out turned into $90 earned in crypto. The conversation expands into onchain loyalty and new user incentives with Clutch Market’s SimpleFarmer and ApeChain’s Shpend. The Coffee Crew breaks down the Base App’s goals and challenges, followed by Bunchu’s take on AI agents that represent users online. The week wraps analyzing ETH’s breakout and how brand coins like Rekt Brands could evolve into lasting loyalty tools.

☕️ Brewing This Week

📰 Monday

Crypto Market Momentum + Motus Art on Motion, Story & Sound

Special Guest:

Owen McAteer - Generative Artist: https://x.com/motus_art

Cap and Steve cover a wave of renewed energy in the crypto space, from Bitcoin pushing toward all-time highs to Pudgy Penguins leading NFT volume on the day. They discuss how crypto credit cards can passively stack BTC, why volume is a more important signal than floor price, and what this kind of market activity could mean going forward. Generative artist Motus Art (Owen McAteer) joins the show to share his cinematic approach to onchain storytelling, breaking down how motion, sound, and slow pacing can elevate digital art into immersive, collectible experiences designed to last beyond hype cycles.

💡 Tuesday

Eat, Pay & Earn Crypto at Blackbird + How ApeChain is Hooking New Users

Special Guests:

SimpleFarmer – Founder of Clutch Market: https://x.com/OxSimpleFarmer

Shpend - ApeChain Community Lead: https://x.com/NGBxShpend

Blackbird's Fly token took center stage after Cap shared a friend’s story of earning $90 in crypto during dinner, prompting a deeper discussion around onchain loyalty and brand coins. Von Frontin and Steve weighed in on whether Fly is just another rewards program or something that could reshape how restaurants connect with customers. Later, Clutch Market founder SimpleFarmer and ApeChain’s community lead Shpend broke down the two-week Spotlight Sprint, where the top 1000 users qualify for prizes and the top 100 compete for even bigger rewards. Their insights showed how ApeChain is focusing on real, active users instead of empty metrics.

🔗 Wednesday

Why Tokens Dump After Airdrops + Big Finance Bets on ETH

Cap and Steve break down why most airdrops flop, pointing to a lack of meaningful utility and poorly structured incentives as the root cause. They challenge Web3 teams to design token economies with actual sinks, use cases, or sustained engagement mechanisms that go beyond hype. The conversation also dives into the difference between NFTs and tokens, debates the role of buybacks, and wraps with a sharp look at Ethereum’s institutional momentum. With inflows from BlackRock, research coverage from Bank of America, and infrastructure growth from major players, ETH is steadily positioning itself as the financial backbone of the next wave of digital markets.

🤖 Thursday

AI Agents Will Represent You Online + Can Base App Redefine Onchain Social?

Special Guests:

Bunchu - Cofounder & CEO of Billy Bets: https://x.com/BunchuBets

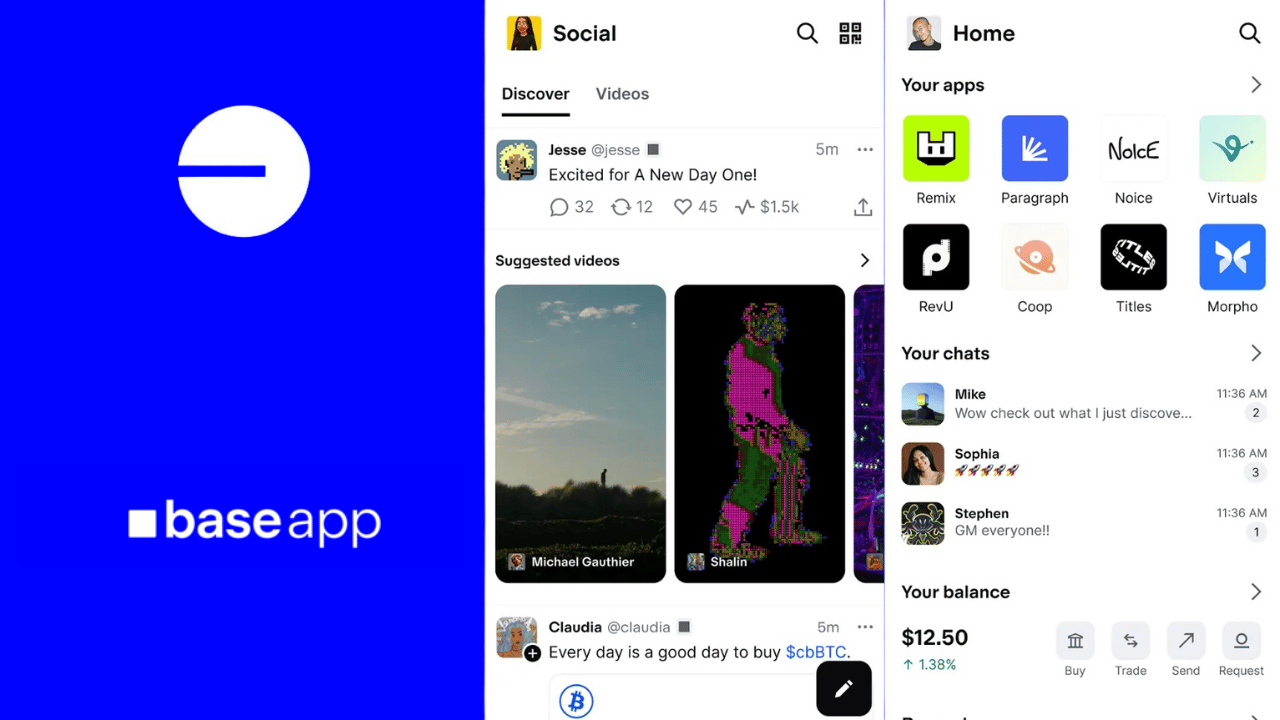

The episode opens with a deep dive into Coinbase’s newly announced Base App as the team questions whether it can reshape how social interaction works in Web3. They discuss the challenge of changing user behavior, the tradeoffs of building a standalone destination, and the broader implications for onchain identity. In the second half, Bunchu shares his vision for a future powered by AI agents and agentic browsers. He explains how tools like Perplexity hint at what’s coming next, with personalized digital agents acting on behalf of individuals and brands. This shift could redefine how we build trust, communicate, and operate online.

🥳 Friday

ETH Hits $3,600, Broken InfoFi Models & Brand Coin Experiments

ETH crossed $3,600 on Friday’s episode, and Cap says it’s not a surprise for those paying attention. He walks through ETF momentum, exchange withdrawals, and a stealth supply shock that could fuel much higher prices. Steve agrees the market is heating up and adds that retail still hasn’t caught on. The back half of the show dives into InfoFi’s broken incentive structure, with Cap and Steve pointing out how misinformation often earns more than accuracy. They close by looking at brand coins, highlighting Rekt Brands as a current example and VeeFriends as a potential blueprint for the next wave.

🎓 Quick Take For Newcomers

ETH Isn’t Just Money, It’s Infrastructure: Think of Ethereum less like Bitcoin and more like an operating system for the internet of value. It’s the default choice for builders, the home of the most active apps and the engine that’s quietly reshaping how we transact online. Stay plugged in to the possibilities.

📺 Weekly YouTube Highlights

Want to see our guests in action? Our YouTube channel features full video episodes, interview-only segments, and quick YouTube shorts featuring key moments. Subscribe now to never miss an episode and see the faces behind the voices!

Have a wonderful, wonderful weekend everybody!

DISCLAIMER: This newsletter contains information presented solely for educational purposes and should not be interpreted as financial or investment advice. Any investment decisions should be made after consulting with qualified professionals. Please be aware that I may own several digital assets discussed in this publication.