- CwC Web3 Weekly

- Posts

- ETH Breaks $3800, Doodles Team Exits & $REKT/$PENGU Hit ATHs

ETH Breaks $3800, Doodles Team Exits & $REKT/$PENGU Hit ATHs

ETH clears $3800 as NFT floors climb with renewed energy

Think Protocol outlines privacy-first AI

$REKT vs $PENGU as they reach all-time highs

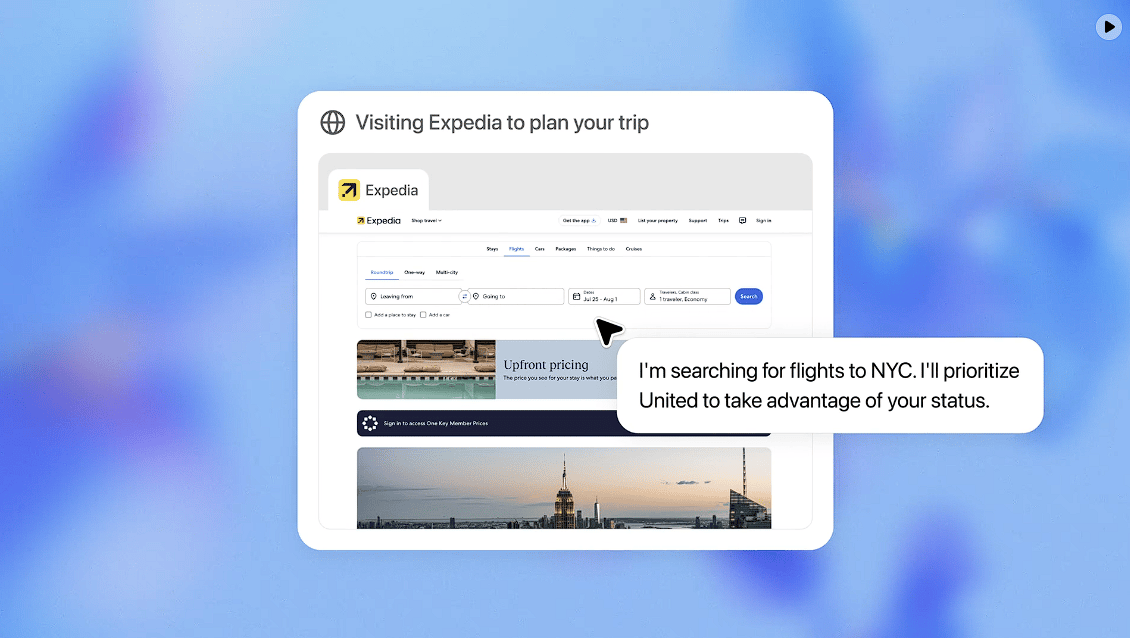

ChatGPT’s agents plan an entire trip on-air

Pixel Vault shutters without delivering token promises

Doodles Team exit leaving DreamNet’s future in doubt

Watch & Listen Now: This week’s Coffee with Captain episodes tracked the signals of a maturing crypto cycle, from ETH strength and NFT rebounds to new frameworks for AI and brand trust. Jason Sibley shared how Zenko turns attention into tangible real-world impact, while the Think Protocol team laid out their plan for ethical, composable AI with a TGE on the horizon. $REKT and $PENGU sparked a fiery debate on token value vs cultural weight, and Bunchu’s live demo of ChatGPT’s agents showed off how close AI is to replacing planning apps. The week closed with fallout from the Doodles leadership exit and a community-wide reflection on what sustainable Web3 brands actually look like.

☕️ Brewing This Week

📰 Monday

Source: Zenko

NFT PFPs Signal Market Strength + Jason Sibley on Turning Attention into Real-World Impact with Zenko

Special Guest:

Jason Sibley - CEO of Zenko: https://x.com/jasondsibley

ETH surged past $3800 as Cap and Steve examined the returning strength in crypto markets and NFT floors, with legacy PFP collections like Apes and Pudgies leading the charge. Loki shared how PFPs have evolved into vital digital business cards, signaling trust and credibility in Web3. The episode’s highlight was an in-depth interview with Jason Sibley, CEO of Zenko, who revealed how his company transforms marketing budgets into real-world climate and community impact, letting users turn their attention into purposeful action backed by blockchain proof. The conversation underscored the importance of sustainable storytelling and execution for long-term success beyond hype cycles.

💡 Tuesday

Source: THINK website

InfoFi Collapse & Creator Monetization Crisis + Think’s TGE for Ethical AI

Special Guests:

Jesse Bryan - Core Contributor at Think Protocol: https://x.com/jessebryan

Mikey Anderson - Core Contributor at Think Protocol: https://x.com/mikeyanderson

Felix Eunson - Core Contributor at Think Protocol: https://x.com/LeftClickSave

Cap and Steve question whether Web3 creator tools are evolving or collapsing as they unpack the failure of Base App and Kaito’s shift away from InfoFi. They call out unsustainable monetization loops and tokenized content overload that frustrate both creators and users. In the second half, the Think Protocol team lays out their plan to fix AI with privacy-first agents and an ecosystem powered by their upcoming token generation event. The interview highlights why decentralized infrastructure is key to building ethical, composable AI systems that serve the user instead of harvesting their data.

🔗 Wednesday

$REKT vs $PENGU, Token Profit Strategies & NFT Market Moves

Cap and Steve go deep on the $REKT vs $PENGU debate, comparing REKT’s equity-backed beverage brand and $290M valuation with PENGU’s cultural dominance and $2.7B market cap. They discuss the psychology of taking profits in crypto, emphasizing the risks of overconfidence and missed exits during bull runs. The show also highlights a $441K Pudgy Penguin sale, Cool Cats resurgence speculation, and signs of growing institutional interest with continued ETH ETF inflows. Their takeaway? We’re still early, and high-conviction bets matter more than ever.

🤖 Thursday

Source: OpenAI

ChatGPT Agent Demo + Pixel Vault’s Sudden Shutdown

Special Guests:

Bunchu - Cofounder & CEO of Billy Bets: https://x.com/BunchuBets

Today’s episode features a live demo of ChatGPT’s new agent tool as Bunchu puts it to the test planning a full football weekend, including tickets, lodging, and even a pitch deck for friends. The conversation turns heated as Cap and Steve debate whether $REKT’s rise signals a repeatable brand coin model or just a rare exception. Later, they criticize Pixel Vault’s shutdown, calling out the team for abandoning promised token agreements and suggesting the IP be handed to someone who can revive it. Other segments touch on pump.fun’s drop and the growth of ETH treasury companies.

🥳 Friday

Source: Burnt Toast

Doodles Team Mass Exodus + Why Web3 Brands Keep Breaking

Doodles faced major scrutiny this week after the abrupt departure of its core leadership team, including longtime product leads and biz dev head Austin Hurwitz. Cap and Steve unpack what this means for the brand’s future, questioning whether DreamNet is still viable and why Burnt Toast’s new roadmap lacks clear direction. Community guests offer sharp insight into missed Asia expansion, unclear token utility, and why other projects like Pudgy Penguins have found more sustainable traction. The episode turns into a broader look at why so many Web3 brands fail after big raises and what the surviving ones have in common.

🎓 Quick Take For Newcomers

Brand Tokens Are Built, Not Branded: Successful tokens go beyond memes and marketing. The ones that last are rooted in real products, clear incentives, and consistent execution. As hype cycles come and go, it’s the brands that create utility and community alignment that continue to grow.

📺 Weekly YouTube Highlights

Want to see our guests in action? Our YouTube channel features full video episodes, interview-only segments, and quick YouTube shorts featuring key moments. Subscribe now to never miss an episode and see the faces behind the voices!

Have a wonderful, wonderful weekend everybody!

DISCLAIMER: This newsletter contains information presented solely for educational purposes and should not be interpreted as financial or investment advice. Any investment decisions should be made after consulting with qualified professionals. Please be aware that I may own several digital assets discussed in this publication.