- CwC Web3 Weekly

- Posts

- Moonbirds Collector Crypt Drop, Abstract Chain's Future & ApeCoin’s Project RAID Expansion

Moonbirds Collector Crypt Drop, Abstract Chain's Future & ApeCoin’s Project RAID Expansion

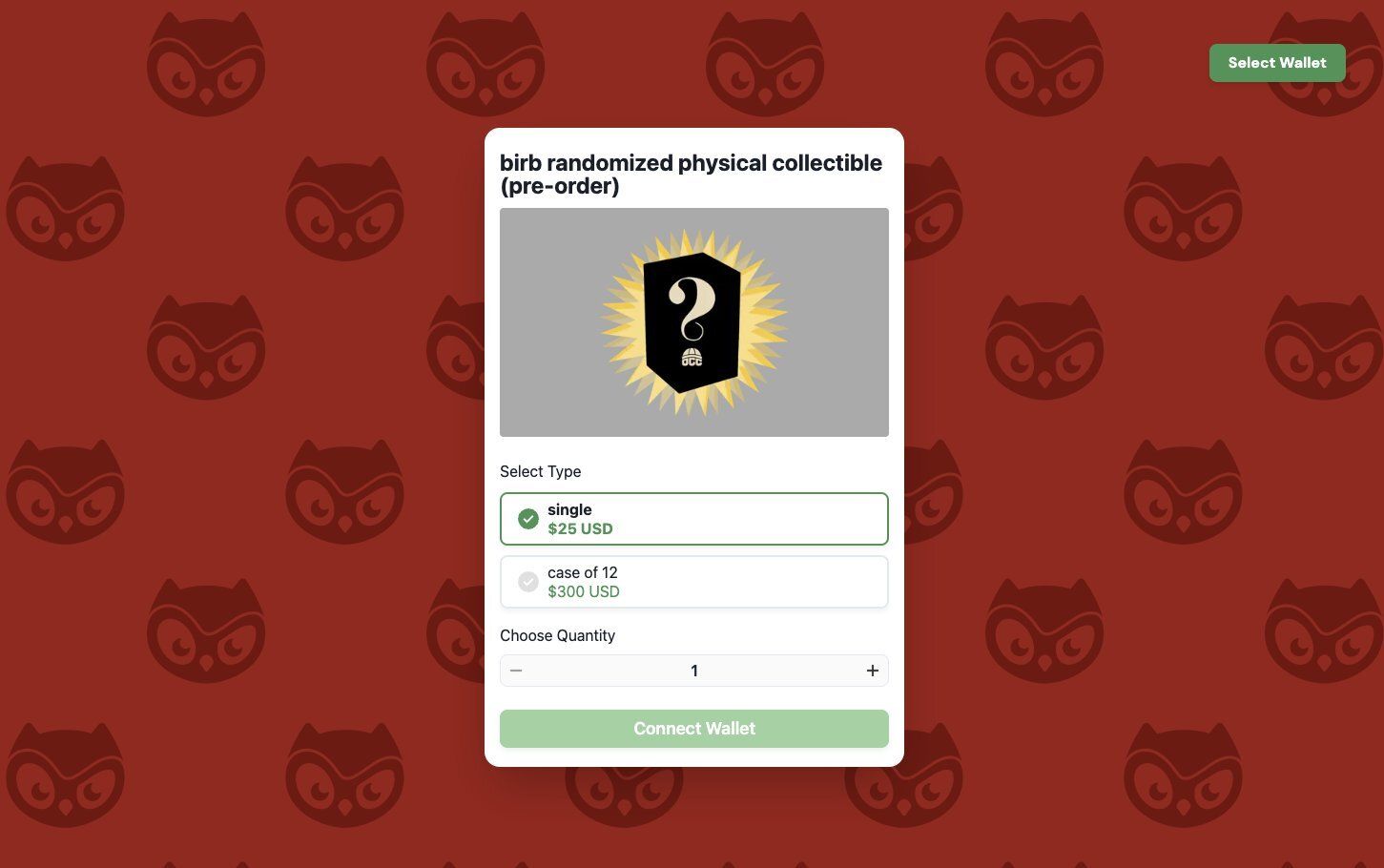

Moonbirds’ Collector Crypt preorder opens, linking physical collectibles with token speculation

Abstract Chain faces scrutiny over its identity and consumer-facing potential

OpenSea’s final rewards phase sparks debate over delays and execution

ApeCoin’s Project RAID pushes into Solana with 19 protocol partners

Runwago enters the spotlight with its move-to-earn SportFi app

NPM hack exposes lingering Web3 security fragility

OpenPage Badge Codes - $10K APE Giveaway

Today’s Link

Collect any badges you missed earlier in the week while you can!

Monday’s Code - cwc70 |

Watch & Listen Now: This week’s episodes covered a wide spectrum of Web3 activity, from speculation-driven collectibles to protocol expansion and security risks. Moonbirds grabbed attention with the Collector Crypt drop, pairing physical goods with token hype to reignite brand momentum. Abstract Chain’s uncertain direction raised questions about whether gambling-heavy dapps can evolve into consumer platforms, while prediction markets solidified their position as a major onchain trend. The crew also dissected OpenSea’s final rewards phase, spotlighted ApeCoin’s Project RAID expansion on Solana, and introduced Runwago as a rising move-to-earn contender. Security concerns flared with the NPM hack, reminding everyone how fragile Web3’s foundation still is.

☕️ Brewing This Week

📰 Monday

Source: ApeChain HUB on X

Prediction Markets Surge + ApeCoin’s Project RAID Expansion

Special Guests:

SimpleFarmer - Head of DeFi at ApeCoin: https://x.com/OxSimpleFarmer

PPman: https://x.com/_PPMan_

Prediction markets are pulling attention away from traditional sportsbooks, and this episode digs into why peer-to-peer platforms are capturing both users and liquidity. The discussion also spotlights Billy Bets’ new automation features for Kalshi strategies and the risks tied to chasing short-term DeFi yields, all set against a quiet market backdrop as investors wait on the Fed’s September 17 meeting. The show wraps with SimpleFarmer and PPman outlining Project Raid, an ApeChain initiative designed to expand ApeCoin’s reach by launching on Solana, integrating with existing protocols, and coordinating with 19 partners to strengthen adoption.

💡 Tuesday

OpenSea’s Final Rewards Phase + NPM Hack Exposes Web3 Fragility

Markets stirred as the crew debated whether alt season has truly arrived, with Bitcoin holding near $112k. The spotlight turned to OpenSea’s long-delayed TGE, where some praised the structured rewards program and NFT reserve approach while others criticized the slow execution and repeated delays. The discussion also broke down the recent NPM hack that briefly redirected wallet approvals, exposing how even small front-end exploits can undermine confidence. The incident served as a reminder that Web3 infrastructure still faces major security hurdles before mainstream adoption can take hold.

🔗 Wednesday

ApeChain Identity Crisis + Move-to-Earn with Runwago

Cap and Steve zeroed in on ApeChain’s identity crisis, challenging the claim that one $APE token equals BAYC membership and arguing that it undermines the collection’s cultural weight. They also touched on Solana’s momentum with Project RAID and walked through Meteora as a simple onramp for liquidity providers. The show closed with a sponsored segment featuring Runwago, a move-to-earn fitness app that blends running challenges with pooled incentives, in-app rewards, and a revenue-share token model. With early traction and strong anti-cheat measures, Runwago is aiming to carve out a leading role in SportFi.

🤖 Thursday

Abstract Chain’s Future Questioned + Gambling Apps vs. Consumer Apps

The show opened with reflections on 9/11 before shifting to Abstract Chain’s uncertain direction and the challenge of defining its role in Web3. Cap and Steve questioned whether Abstract can move past badges, promos, and gambling-heavy dapps to establish a true consumer-facing identity. They weighed the potential of its streaming and tipping model, which creates direct incentives between creators and audiences, against skepticism about whether it can sustain real adoption. The discussion then expanded into DeFi strategies across Turtle, Kaito, Hyperliquid, and Katana, contrasting short-term farming loops with projects like Polymarket and Billions that are building durable onchain value.

🥳 Friday

Moonbirds’ Collector Crypt Drop + What Pump.fun Means for Creator Coins

Cap and Steve spotlighted Moonbirds’ latest move as Orange Cap Games rolled out the Collector Crypt drop, offering preorder access to randomized physical collectibles that could shape the brand’s next chapter. They discussed how the combination of physical goods and token speculation might drive renewed demand for Moonbirds in a crowded NFT market. The show also covered Pump.fun’s rising influence, where creator coins linked to streaming and fee-sharing models are sparking excitement, fueled further by a surge in airdrop speculation heading into September.

🎓 Quick Take For Newcomers

Keep Security First: Before you worry about making gains, make sure you can keep what you earn. Use hardware wallets when possible, avoid clicking unknown links, and double-check approvals. In crypto, protecting your assets is the first win.

📺 Weekly YouTube Highlights

Want to see our guests in action? Our YouTube channel features full video episodes, interview-only segments, and quick YouTube shorts featuring key moments. Subscribe now to never miss an episode and see the faces behind the voices!

Have a wonderful, wonderful weekend everybody!

DISCLAIMER: This newsletter contains information presented solely for educational purposes and should not be interpreted as financial or investment advice. Any investment decisions should be made after consulting with qualified professionals. Please be aware that I may own several digital assets discussed in this publication.